Achieving True Digital Mortgage Using Emerging Technologies

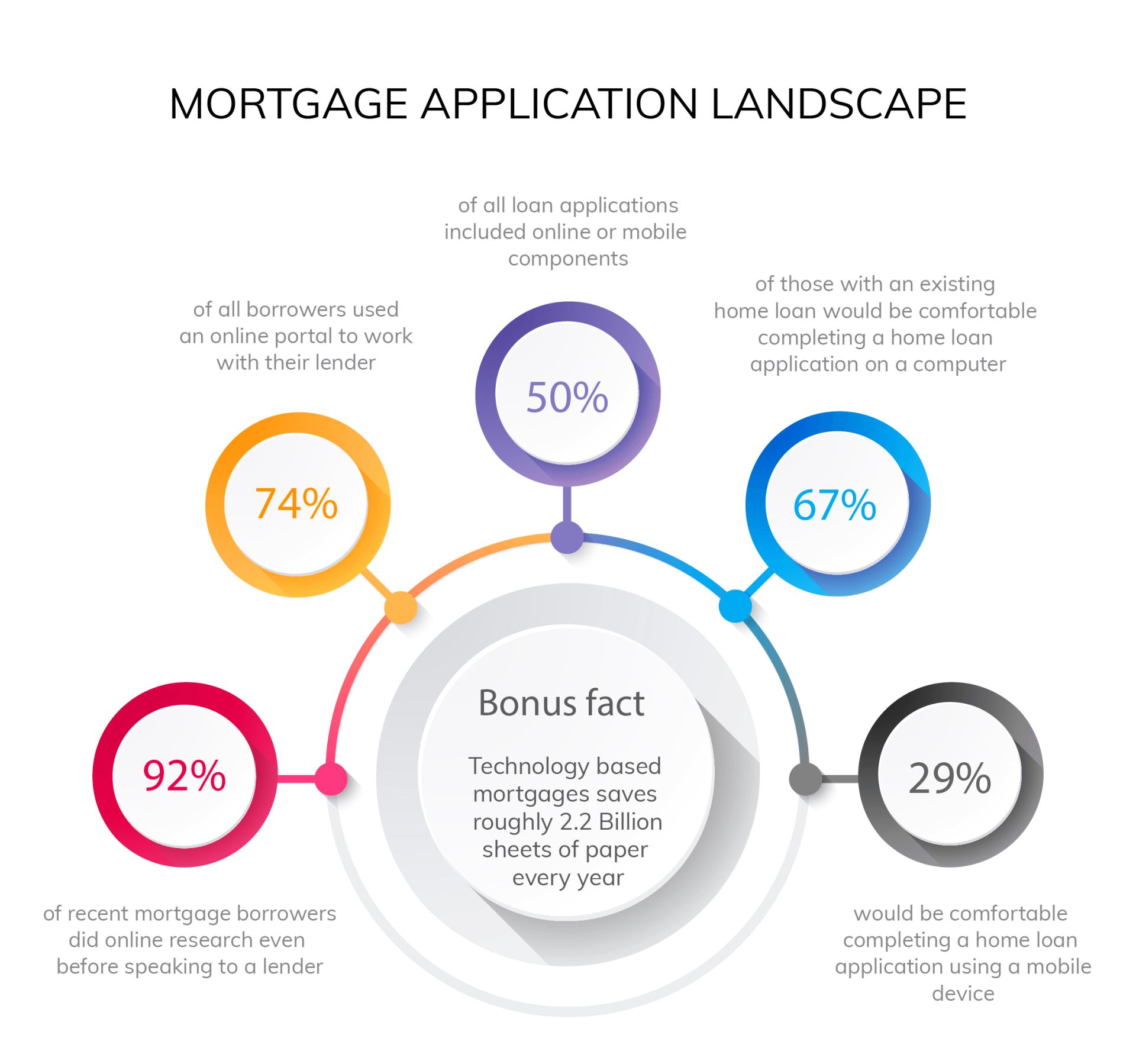

It is no secret that millennials comprise the biggest share of the mortgage market throughout the previous five years. As Millennials are currently entering their top home-purchasing years, their wish to settle down would influence more home sales in the coming time. Millennials are technology-savvy, they own smartphones, have grown up with cutting-edge innovation readily available, and expect the sort of customized experiences provided by the emerging technologies.

The basis of rivalry in the mortgage business is very clear: Be the ease maker of the loan while charming borrowers with a remarkable yet customized experience. Doing as such inside an exceptionally serious market calls for delivering a true digital mortgage value—the sort that is automated, of top quality, effective and productive. It requires a mix of various emerging technologies. Not only digital mortgage makes the process smoother for borrowers to obtain a mortgage loan from primary lenders but it also makes it easier to apply for obtaining the loan from secondary markets when anyone needs to take out a loan serviced by a financial institution i.e. banks.

In this piece, we shall take a closer look at how mortgage lenders can leverage digital innovation and emerging technologies to deliver a better experience.

Achieving the true digital mortgage value

Mortgage lenders that need to create the most value, greater effectiveness, and edge out of their loan fulfillment process should implement innovative digital skills and capabilities across their mortgage operations.

Highly manual and redundant processes are a part of the primary contributors to loan expenses. Mortgage lenders need to assess all aspects of the credit lifecycle to perceive what measures they can automate, and how, to expand cost productivity.

Using robotics process automation (RPA) to imitate human activities in routine tasks is a typical starting point that seems to be efficient. It is accessible to carry out rapidly and at a negligible cost. RPA can be deployed to automate the completion of essential tasks for different functions—from loan processing to compliance and report automation.

Mortgage lenders can likewise leverage artificial intelligence (AI), as machine and deep learning, to not just automate tasks, but to help drive insights of knowledge and make decisions dependent on that information, experience and interactions, creating more opportunities for process improvement and cost savings.

Moreover, chatbots are turning into fundamental co-workers for the new digital age. Chatbots in the banking sector will assume a huge part in cost saving by 2023. Big, worldwide banks and credit card organizations have already deployed some sort of chatbot in their operations, enhancing customer support demands and easing the employee experience, too.

Leveraging the emerging technologies and tools for digital mortgage

Banks and mortgage lenders can use various emerging technologies and tools to change the borrower and the lender experience like Microsoft Azure. They can use the capability of artificial intelligence, machine learning, data science, and cognitive services available on Azure that will provide a reconsidered experience to their customers and their borrowers.

Microsoft Suite offers amazing digital opportunities to transform the experience of mortgage and consumer borrowers. To achieve this, banks and mortgage lenders should work in an industry-changing approach to deploy, operate, and secure software and services for the future digital mortgage.

This integration will utilize Azure to drive new levels of working scale, end-to-end digital agility, and improved speed-to-market for the end-users that contain a wide ecosystem of digital mortgage capabilities such as borrowers viewing the home-buying process as a single and easy transaction or stakeholders working together seamlessly on a single platform.

It will likewise bring enhanced data management and customer analytics that will be enhanced by Azure AI and Machine Learning tools to deliver an extraordinary experience for lenders and borrowers altogether. They can provide the usability of data extraction, document indexing, and connecting the lenders with third-party service providers.

Additionally, AI can assume a significant part in underwriting. AI can update the analysis promptly as new information is available and enhance risk management to make a more precise recommendation. The capable AI tools would then be able to be leveraged to analyze the surge of clinical and non-clinical information and update risk estimations promptly, not just giving more accurate underwriting results to the insurer but also promising better practices than traditional underwriting.

Conclusion

Because of the presence of multiple stakeholders, such as loan originators, underwriters, legal teams, and IT staff, inside the mortgage process and the absence of constant data sharing, processes are still lacking behind all through the financial sector – leading to more lead time, poor user experience, and low satisfaction. There is a critical need to put these pieces together and generate the true value for borrowers.

Each one of these issues can be solved by building a single application that can utilize the present emerging technologies to connect the dot from an end-to-end viewpoint. It will require a ton of data sharing, joint partnerships, and industry normalization. But it is, in no way, unachievable.